LOS ANGELES—New supply is here and it's going to cause appreciable pain for the hospitality industry. While the opening-day tenor at the Americas Lodging Investment Summit, here at the JW Marriott L.A. Live, was one of self-assurance, an air of caution rippled through the Microsoft Theatre now that, according to most prognosticators, the hotel industry's supply/demand quotient has tipped in favor of the former.

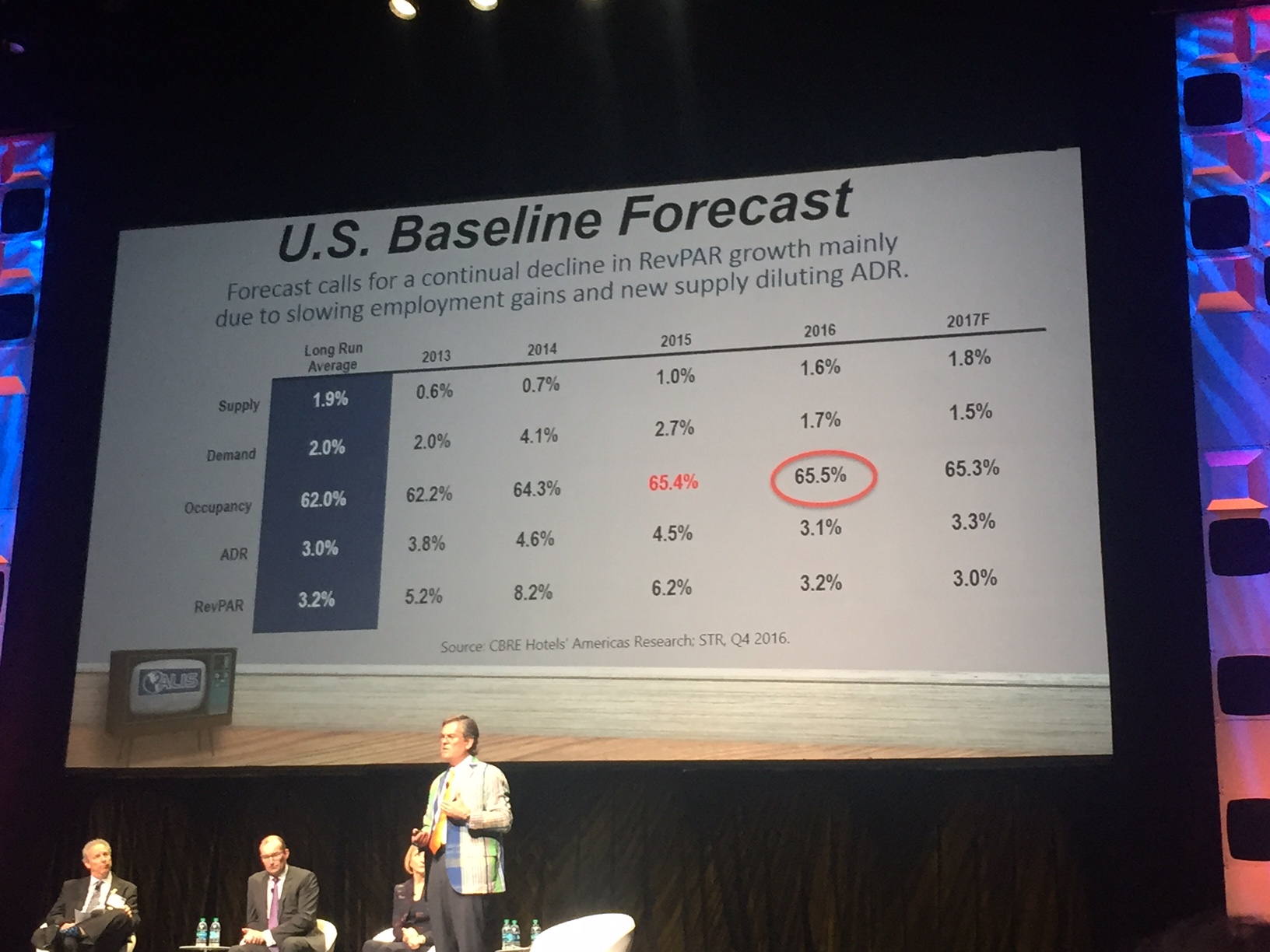

"2017 will be the year where supply finally surpasses demand," said Mark Woodworth, senior managing director of CBRE Hotels’ Research.

According to CBRE's baseline forecast, 2017 will see 1.8-percent growth in supply against a 1.5-percent growth in demand. Supply issues have not been something the hotel industry has had to deal with over the past couple of years. But growth in supply has ramped up since 2015. Last year it grew 1.6 percent YOY, according to CBRE, still lower than demand growth at 1.7 percent.

Growth in supply is having a deleterious impact on RevPAR, CBRE points out, exacerbated by slowing employment gains and diluted ADR growth. According to CBRE, RevPAR is forecasted to grow 3 percent this year, a full 5.2-percent lower than where it stood in 2014.

Investing in 2017

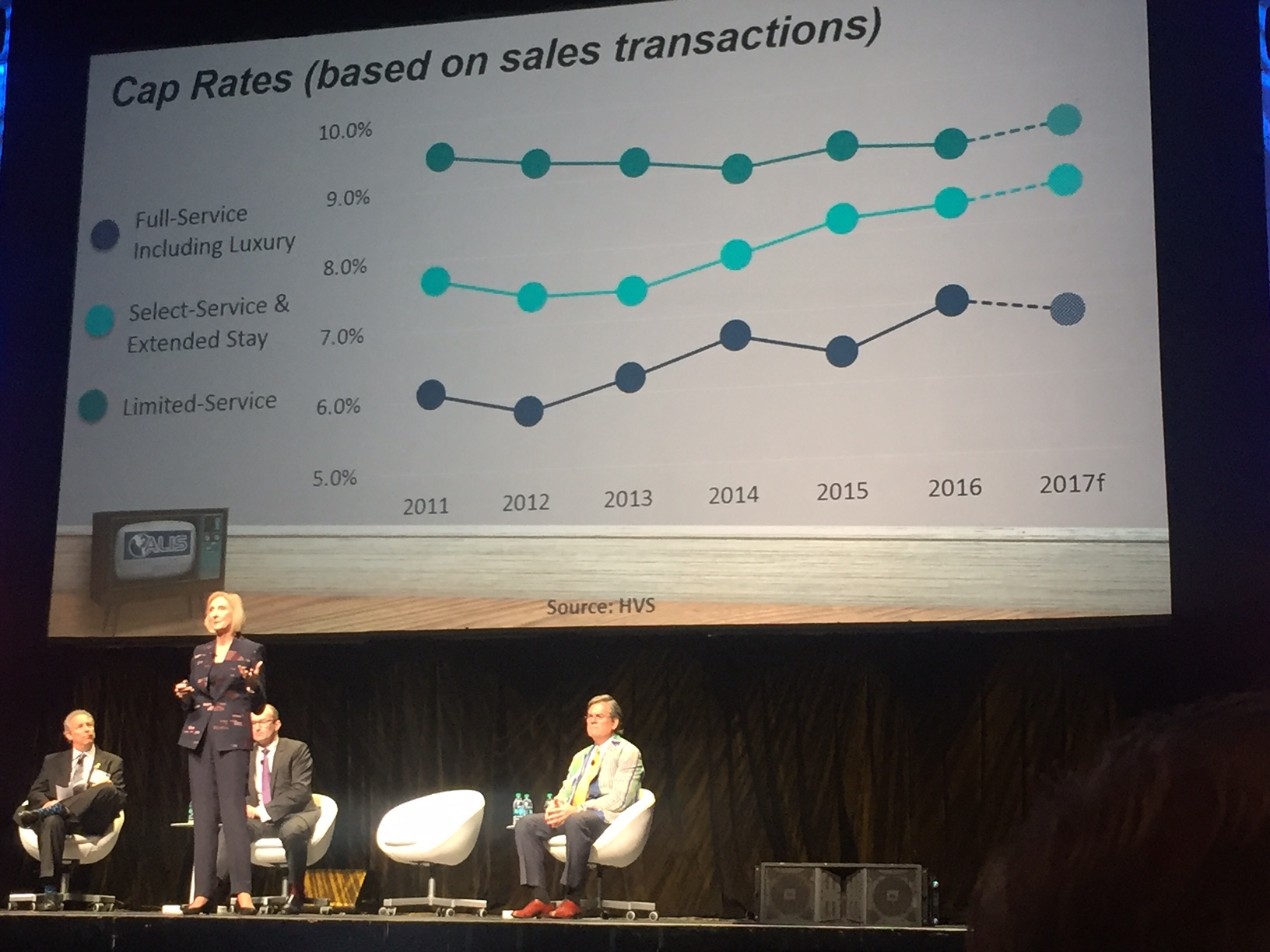

On the investment side, Suzanne Mellen, senior managing director of HVS, said cap rates have been ticking up and will rise modestly in 2017, based in part on rising interest rates and slowing RevPAR growth. Mellen also lamented the rise in supply growth and said that new supply was impacting the buy/sell gap and, further, seller expectations.

Still, investment in the hospitality industry should remain strong; likewise, so should cross-border investment by overseas groups into the U.S. "It will continue to be active," Mellen said, "but reduced because it'll be hard to replicate [2016]."

Some notable deals included: Last October, China Life Insurance Co. Ltd., China's largest life insurance company, invested with $2 billion in a select-service portfolio; a month earlier, Anbang competed the $6.5-billion acquisition of the Strategic Hotels & Resorts portfolio—save for the Hotel del Coronado in San Diego—from Blackstone Group.

In the U.S., Mellen said that REITs will rebound off 2016, adding that they had recaptured some 80 percent of their value. Meanwhile, she is expected that institutional investors would dispose off assets this year.

Asked the best place to invest if they could, Mellen, along with Jan Freitag, SVP of STR, said California, noting high barriers of entry. For Mellen, coastal markets, like San Francisco, remain the priciest to invest in. "They are so hard to build in," she said.

This year, the theme at ALIS is: "Please Stand By." For the some 3,000 delegates attending, they may want to take a seat for this.