Last year was a good one for Ireland's hotel scene, and a great year for Ireland's biggest hotel owner and operator.

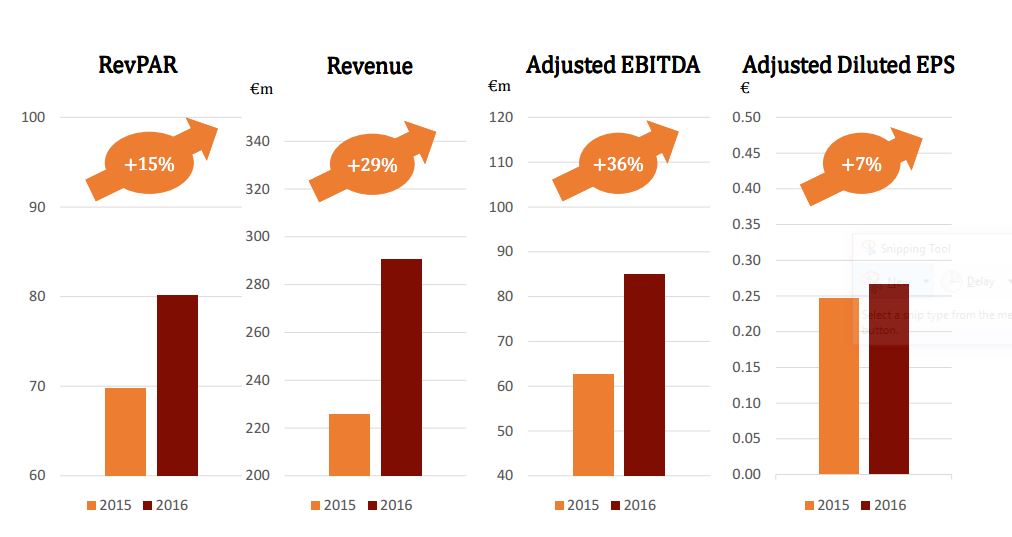

In 2016, Dalata's revenues improved almost 30 percent to €290.5 million. The company's overall occupancy rate reached 82.1 percent for 2016, up from 80.2 percent in 2015, and average daily rate rose to €97.6, up from €87 in 2015.

Dalata added seven hotels with just under 1,600 guestrooms to its portfolio, and now has a pipeline of more than 1,200 rooms slated to open in 2018 alone. The company also brought four of its hotels to its Clayton brand, and renovated 750 rooms for €8.2 million.

Dalata currently has 34 hotels in its portfolio, 24 of which are owned and 10 are leased. Seven are managed under two core brands.

Dublin's Strengths

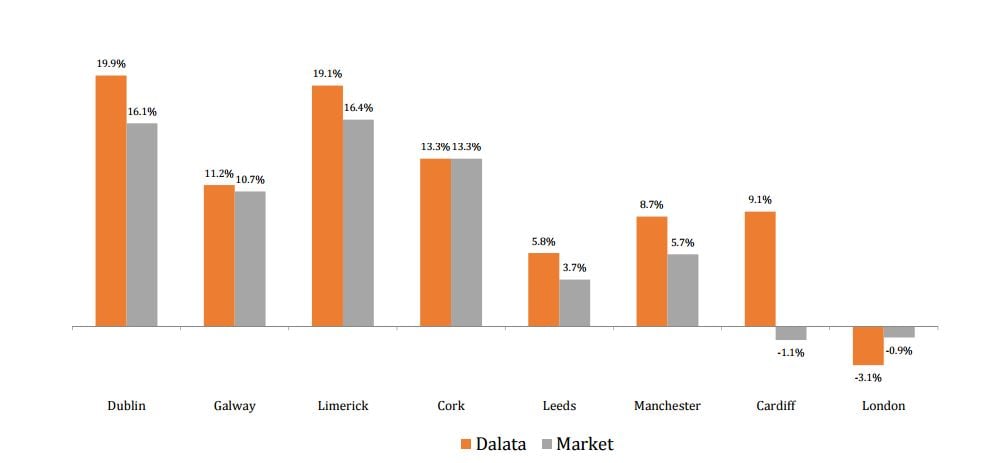

"The markets we’ve been operating in had a very good year," Dermot Crowley, Dalata’s deputy chief executive, told HOTEL MANAGEMENT. "We’re really starting to benefit now from the number of hotels we have in [Dublin], and the infrastructure and office support we’ve put behind those hotels as well." The city's Dublin hotels outperformed the market with RevPAR growth of 19.9 percent compared to the city's average of 16.1 percent. Dalata's occupancy numbers for Dublin also rose to 85.7 percent from 83.1 percent—a strong indication of the city's need for more hotel rooms.

To that end, Dalata added 680 rooms to its Dublin portfolio last year, adding the Tara Towers in January, Gibson in March and the Clayton Hotel Burlington Road in November.

Next year, Dalata will open 550 new rooms in Dublin, with a Clayton and a Maldron in the city center and extensions at several others. After that, Crowley expects a "few thousand" other rooms to open. And while Dublin needs guestrooms, the process of bringing a hotel to life in the city can be challenging. "Planning permission can be slow in Dublin, and then on top of that, getting funding for projects can be difficult as well," Crowley said. "There aren’t a lot of big players in Dublin. It’s very fragmented, so they find it harder to get funding than we would for new properties."

The lack of big fish in the (relatively) small pond gives Dalata an advantage when it comes to getting approvals—and money. "It is easier to get funding because we perform well," Crowley said. "We tick all the boxes that the banks are looking for. It's harder for smaller operators because the deals start getting riskier for the funders. That’s what slows down the number of hotels. Marriott, Hilton—they won’t put a covenant behind just any lease. So that makes the funders slow to fund hotels."

As such, Crowley acknowledged, "supply and demand is out of sync at the moment, but that will correct itself as we go into 2019 and 2020." The company is poised to benefit from "very limited new supply" in Dublin through late 2018. For this year, STR is predicting 5.5 percent RevPAR growth for Dublin, and growth in January was 9.2 percent.

Regional Ireland

Other major cities for Dalata are Cork, Limerick and Galway, where Crowley said the company also outperforms the market. "What they’re being driven by is foreign direct investment, primarily from the U.S., multinationals and the domestic consumer," he said.

Looking ahead, Crowley is optimistic for these markets. "As long as the economy remains strong, those cities will be strong," he said. "We’ve brought good assets with good teams—good revenue managers, very good general managers—and they’re performing well versus the competition. Ireland has been a very good news story for the last three years, and the prospects remain very strong."

An Uneven United Kingdom

The UK painted a different picture, however. Dalata's London hotels had a "very difficult" first half of 2016, which the company blames on increased supply. Crowley also noted an extension and renovation to the company's Chiswick hotel, which may have brought down overall numbers. Ultimately, however, the city ended 2016 stronger and has seen a strong start to 2017. STR is expecting RevPAR growth of 2.5 percent for London this year, and already saw 12-percent growth in January.

Other cities fared better. Belfast had very strong second half of the year, boosted by the reopening of the Waterfront Conference Centre. Cardiff 's numbers were down, but the city hosted the Rugby World Cup in 2015. Overall, Crowley noted, the UK forms a quarter of Dalata's business, and hotels in Leeds, Manchester and Cardiff all outperformed. Across the company's eight hotels in the UK, overall RevPAR increased 4.4. percent last year.

The Brexit, Crowley said, has not affected Dalata's hotels at all, although he calls it "a risk on a macro basis" in terms of roomnights going to UK travelers facing a devaluation of the pound. "For our London hotels, we're starting to see the benefit of a lower exchange rate," he said. "For the regional hotels, it's too early to say."