According to the December 2021 edition of CBRE’s Hotel Horizons, all 65 major U.S. lodging markets are expected to achieve revenue per available room gains in both 2022 and 2023. Despite these gains, it will not be until 2024 that the aggregate RevPAR for all 65 markets will exceed what these same markets achieved in 2019. This is a full year after the entire U.S. lodging industry is forecast to exceed its 2019 RevPAR level.

In general, the major markets are more dependent on corporate and group demand, the two segments most negatively impacted by the continued presence of the COVID pandemic. The suppressed levels of demand not only lower CBRE’s occupancy projections, but they also curb the forecast gains in average daily room rates as well. On average, ADR levels for the 65 Horizons markets are expected to exceed 2019 levels in 2023, one year after hotels elsewhere in the nation.

Relative Occupancy Strength

Within the 65 major markets, hotels with lower ADR levels are forecast to recover to 2019 occupancy, ADR and RevPAR levels earlier than those with higher room rates. Major-market properties that operate in the economy or midscale segments are projected to exceed their 2019 RevPAR by 2023. Because the hotels that operate in these chain-scales are less dependent on corporate and group demand, they are the only ones expected to return to prepandemic occupancy levels. This also gives them pricing power. The ADR for the lower-priced hotels should exceed 2019 average prices by year-end 2022.

Conversely, the two higher-priced chain-tiers are not expected to return to their all-time-high 2018 and 2019 occupancy levels in the foreseeable future. This, combined with an ADR recovery in 2023, results in a RevPAR recovery delay until 2024.

Location Influence

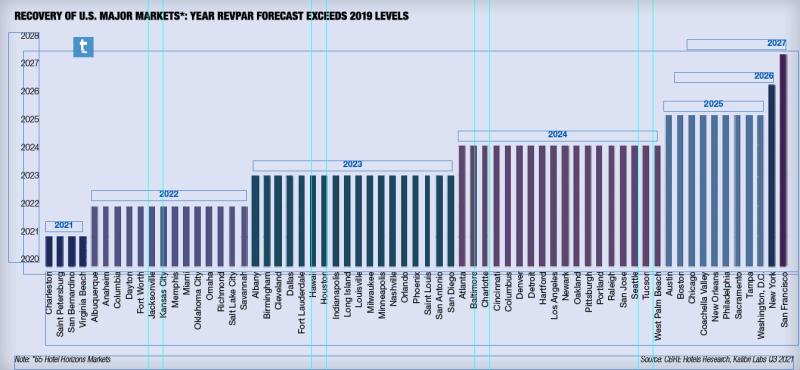

The location of a market obviously influences when the hotels in that geography are forecast to exceed their 2019 RevPAR levels. Analyzing pace of RevPAR growth among the 65 Horizons markets, we find four that achieved RevPAR recovery in 2021, and another 14 that should return to 2019 levels in 2022. Of these 18 markets, all are secondary or tertiary cities and most have a strong tourist orientation. Six are in the Southeast region and adjacent to either the Atlantic Ocean or Gulf of Mexico.

On the other end of the spectrum, hotels located in New York and San Francisco will not see their RevPAR return to 2019 levels until 2026 and 2027, respectively. These are two of the most expensive lodging markets in the U.S., and are very dependent on conventioneers and international travelers.

Size, price and location are clearly the differentiating factors that will dictate lodging market performance in the years to come.

Robert Mandelbaum is director of research information services for CBRE Hotels’ Americas Research.