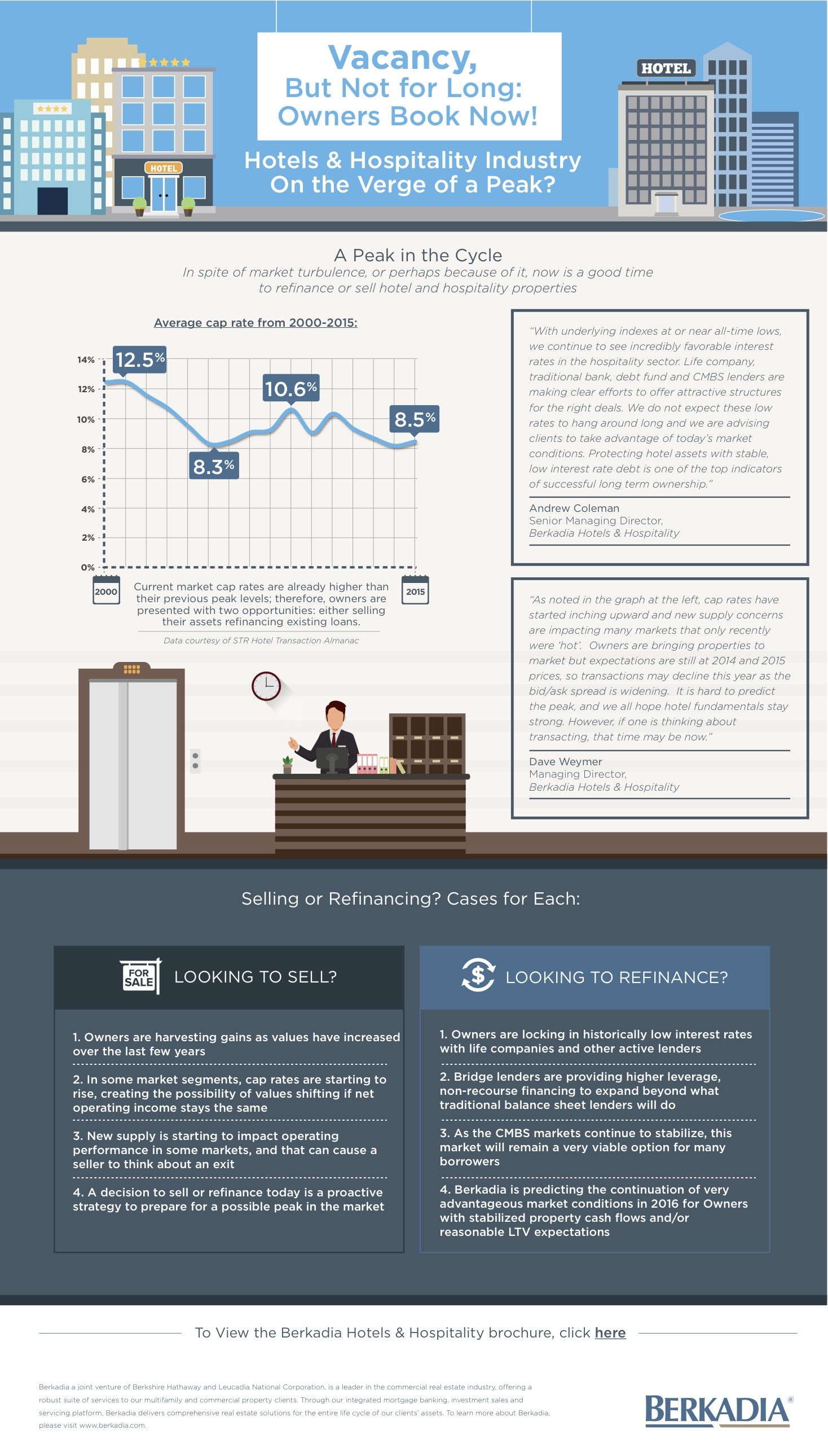

Thanks to several advantages in the market, real estate asset owners may want to consider selling or refinancing their properties in the short term.

According to Berkadia’s Hotels & Hospitality group, this may be a good time to sell because in some market segments, cap rates are starting to rise, creating the possibility of values shifting if net operating income stays the same.

At the same time, this may be a good time to refinance because as the commercial mortgage-backed securities markets continue to stabilize, the hotel and hospitality space will remain a very viable option for many borrowers.