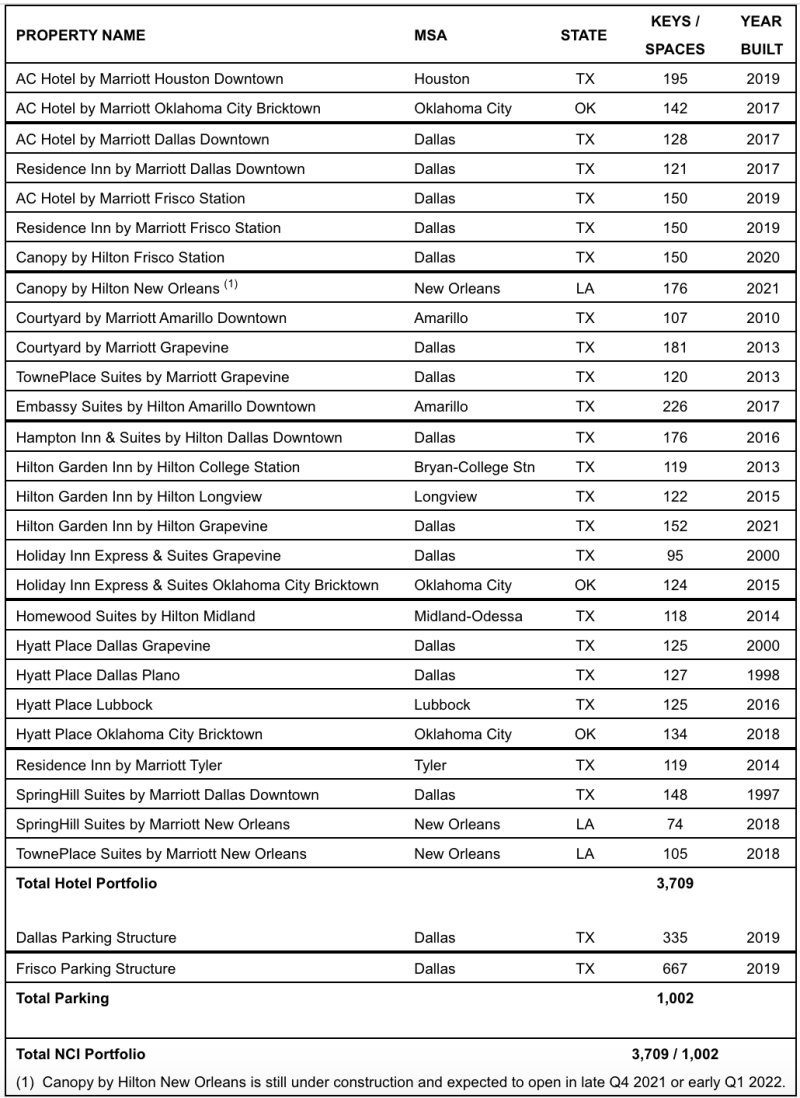

Summit Hotel Properties has entered into a definitive contribution and purchase agreement to acquire a 27-hotel portfolio totaling 3,709 guestrooms, two parking structures and various financial incentives through its existing joint venture with GIC for total consideration of $822 million from affiliates of NewcrestImage.

The total consideration for the transaction is comprised of $776.5 million, or $209,000 per key, for the 27-hotel portfolio, $24.8 million for the two parking structures and $20.7 million for the various financial incentives.

The transaction would increase Summit’s total room count by nearly 35 percent to more than 15,000 rooms at 100 hotels in 42 markets across the country. Through the issuance of common operating partnership units, the company's equity capitalization will increase approximately 15 percent and its total enterprise value will increase approximately 20 percent.

Upon completion of the transaction, Summit’s joint venture with GIC will have invested approximately $1.3 billion of capital.

The Properties

The transaction significantly expands the company's exposure to high-growth Sun Belt markets in the southern U.S. region characterized by robust population and job growth. Approximately 50 percent of the acquisition portfolio is located in four submarkets of the greater Dallas/Fort Worth metropolitan statistical area.

Six of the hotels in the portfolio, comprising approximately one-third of the total portfolio valuation, opened in 2019 or later. The average effective age of the acquisition portfolio is 3.8 years, and more than 70 percent of the guestrooms were developed since 2015, which the company expects will minimize near-term capital expenditure needs.

“We are thrilled to announce this transformational investment opportunity for the acquisition of 27 hotels that are complementary to our existing portfolio of high-quality, well-located assets and significantly expands our presence in high-growth Sun Belt markets,” said Jonathan P. Stanner, the company's president and CEO. “We have creatively structured the transaction with the issuance of both common and preferred operating partnership units and continued our partnership with GIC, which will preserve nearly all our existing liquidity of approximately $450 million. We expect the transaction to be immediately accretive to earnings and leverage-neutral to our balance sheet leaving us ample investment capacity to continue to grow our portfolio.

“The announcement reinforces our optimism about the outlook for our business and validates our unique ability to source and pursue a broad range of capital alternatives and external growth opportunities given our strong liquidity profile, well-positioned balance sheet, and overall resilient portfolio."

"We at NewcrestImage are extremely honored and proud to craft this transaction with the outstanding team at Summit Hotel Properties. NewcrestImage has assembled a collection of high-quality distinctive Marriott, Hilton, Hyatt and IHG hotel properties throughout the Sun Belt region, which will be a great addition to Summit's portfolio,” said Mehul Patel, managing partner and CEO of NewcrestImage. “As we will become one of Summit's largest shareholders, we have confidence in Summit as one of the industry's leading owners with a highly regarded public platform. We believe the two portfolios create an excellent combination of hotels that have tremendous growth potential and are well-positioned to create long-term shareholder value as the lodging recovery continues.”