The hospitality industry continues to see empirical evidence of the resilience of travel, according to Anthony Capuano, president and CEO of Marriott International, and that evidence is reflected in the company’s fourth quarter and full-year 2022 results.

“Our performance in 2022 was terrific. Just two years after experiencing the sharpest downturn in our company’s history, we reported record financial results,” he said. “Our fee-driven, asset-light business model generated significant cash during the year, allowing us to both invest in the growth of our business and return $2.9 billion to shareholders.”

During the fourth quarter, worldwide revenue per available room grew 5 percent compared to 2019, driven by a 13 percent increase in average daily rate, Capuano said. With the exception of Greater China, RevPAR in all regions more than fully recovered and continued to show meaningful advances in occupancy and ADR. Marriott’s international business posted RevPAR 3 percent above 2019 levels in the fourth quarter.

“In our largest region, the U.S. and Canada, RevPAR increased 5 percent over the 2019 quarter, driven by further improvement in occupancy and an 11 percent increase in ADR,” he said. “Leisure demand remained robust and group demand more than fully recovered, leading to fourth-quarter group revenues 10 percent above prepandemic levels. Business transient demand was at nearly 90 percent recovery in the quarter, while ADR was 3 percent above 2019. Our successful negotiation of high single-digit special corporate rate increases for 2023 bodes well for continued price strength.”

Capuano said that owners and franchisees continue to show a strong preference for the company’s brands.

“Our development team had an excellent year, signing nearly 108,000 rooms globally,” he said.“We were pleased to see nearly 40 percent of those rooms in high-value luxury and premium brands. With nearly 50 percent of rooms signed during the year in international markets, we look forward to further expanding our distribution.”

Fourth Quarter 2022 Results

Marriott’s reported operating income totaled $996 million in the 2022 fourth quarter, compared to 2021 fourth quarter reported operating income of $635 million. Reported net income totaled $673 million in the 2022 fourth quarter, compared to 2021 fourth quarter reported net income of $468 million.

Adjusted operating income in the quarter totaled $926 million, compared to 2021 Q4 adjusted operating income of $578 million. Fourth quarter 2022 adjusted net income totaled $622 million, compared to 2021 fourth quarter adjusted net income of $430 million. The adjusted results excluded cost reimbursement revenue, reimbursed expenses and restructuring, merger-related charges and other expenses.

Base management and franchise fees totaled $945 million in the 2022 fourth quarter, compared to base management and franchise fees of $737 million in the year-ago quarter. The year-over-year increase in these fees is primarily attributable to RevPAR increases due to the continued recovery in lodging demand, as well as unit growth, partially offset by $16 million of unfavorable foreign exchange. Other non-RevPAR related franchise fees in the 2022 fourth quarter totaled $215 million, compared to $186 million in the year-ago quarter, largely driven by higher credit card branding fees.

Incentive management fees totaled $186 million in the 2022 fourth quarter, compared to $94 million in the 2021 fourth quarter. Fees in the quarter surpassed 2019 levels, with 60 percent earned in International markets.

Owned, leased and other revenue, net of direct expenses, totaled $101 million in the 2022 fourth quarter, compared to $33 million in the year-ago quarter. The year-over-year increase in revenue net of expenses largely reflects the continued recovery in lodging demand and $21 million of higher termination fees.

General, administrative and other expenses for the 2022 fourth quarter totaled $236 million, compared to $213 million in the year-ago quarter. The year-over-year change included an $18 million favorable litigation settlement in the 2021 fourth quarter.

Adjusted earnings before interest, taxes, depreciation and amortization totaled $1.09 billion in the 2022 fourth quarter, compared to fourth quarter 2021 adjusted EBITDA of $741 million.

Selected Performance Information

The company added 145 properties (22,589 rooms) to its worldwide lodging portfolio during the 2022 fourth quarter, including nearly 6,900 rooms converted from competitor brands and approximately 16,700 rooms in international markets. Eighteen properties (4,484 rooms) exited the system during the quarter. At the end of the year, Marriott’s global lodging system totaled nearly 8,300 properties, with over 1,525,000 rooms.

Also at the end of the year, the company’s worldwide development pipeline totaled 3,028 properties with more than 496,000 rooms, including 1,009 properties with approximately 199,000 rooms under construction, or 40 percent of the pipeline, and 133 properties with roughly 22,300 rooms approved for development, but not yet subject to signed contracts.

In the 2022 fourth quarter, worldwide RevPAR increased 28.8 percent (a 25.6 percent increase using actual dollars) compared to the 2021 fourth quarter. RevPAR in the U.S. and Canada increased 23.6 percent (a 23.3 percent increase using actual dollars), and RevPAR in international markets increased 45.1 percent (a 32.2 percent increase using actual dollars).

Company Outlook

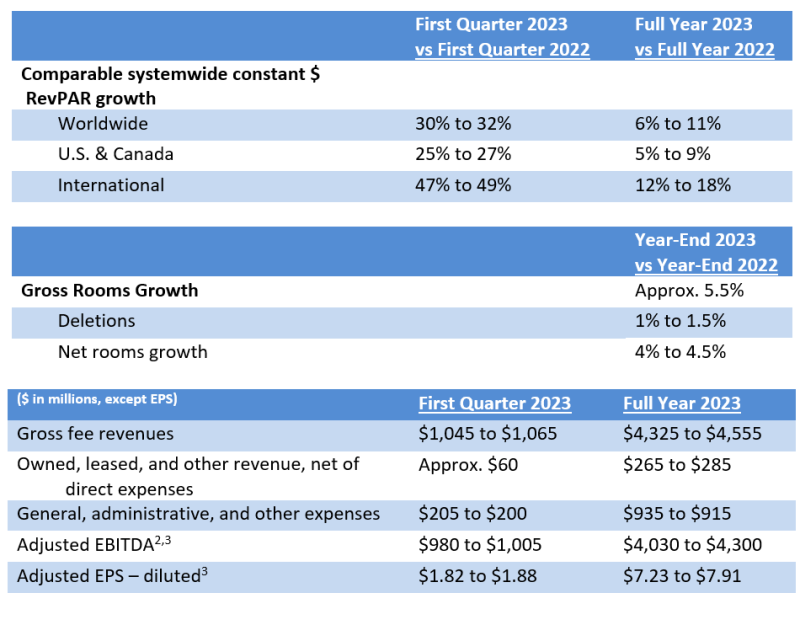

Results in the first quarter are expected to benefit significantly from the easier comparison to the 2022 quarter when the emergence of omicron depressed lodging demand.

Roughly halfway through the quarter, Capuano said global booking trends remain robust. In January, worldwide RevPAR was up 51.6 percent year over year.

Given short-term booking windows and a high level of macroeconomic uncertainty, there is less visibility in forecasting the company’s financial performance for full year 2023. As a result, the company is providing a broad range of potential full year RevPAR and other key metrics in the following tables. The high end of the range reflects relatively steady global economic conditions throughout 2023, with continued resilience of travel demand across customer segments and markets. The low end of the range reflects a meaningful softening of the global economy beginning in the second quarter with worldwide RevPAR roughly flat compared to 2022 in the second half of the year.

Additional Company Information

Marriott also announced that Craig S. Smith, group president, international, has announced his decision to retire on Feb. 24 after a 35-year career with the company.