Africa's hotel development keeps on growing. According to an annual survey of the region's growth by W Hospitality Group, hotel development increased by 13 percent in Africa this year.

W Hospitality Group MD Trevor Ward said in a statement, "The world in 2017 is a very different place to when we started this survey in 2009. But Africa is still rising, at least as far as the development activities of the hotel chains is concerned. While the chains do not, generally, build or invest in the hotels they brand, at the other side of every deal there is an investor eager to do so."

W Hospitality Group's ninth Hotel Chain Development Pipelines in Africa, ninth edition, found 417 hotels with nearly 73,000 rooms in the works for the continent. Marriott International and AccorHotels had the largest new hotel construction pipelines in Africa compared to other competitors. Marriott has 16,393 in its pipeline, while AccorHotels has 84 hotels in development.

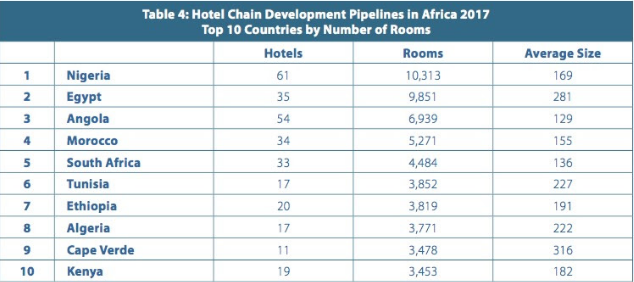

In terms of countries, Egypt has claimed first place with the highest number of hotel rooms already under construction. Notably, the report found that North African countries, which have faced several years of turmoil and uncertainty, are regaining investor confidence. These countries include Egypt and Tunisia. The top ten African countries with the most hotel deals include five North African countries. Several of these deals were signed in 2016, including 12 in Egypt. While Nigeria has the most rooms and hotels in its development pipeline, Egypt has the most currently under construction at almost 75 percent of the total.

Two of Accorhotels' brands—Ibis Styles and Grand Mercure—are in the top five spots for the number of hotels currently in development. These pipelines are primarily in Angola. However, Hilton has snagged Radisson Blu's top spot in terms of the number of rooms signed. Marriott, Accorhotels, Hilton and Carlson Rezidor Group have remained the top four hotel chains by pipeline status. 100 new hotels are planned to open this year and 117 next year. According to the report, these expectations are often over-optimistic.

Many African countries struggled in 2016 with decreased oil prices and other commodities, devalued currencies and other negative factors. These challenges may have affected confidence within the African hotel market in the short-term. The number of signed hotel deals decreased to 86, compared to 121 deals in 2015. Some countries gained an advantage from the cheaper oil imports while southern and eastern Africa experienced increased activity.

In addition, more hotel chains established development offices in Africa to address its massive lack of lodging. Industry growth is expected to slow down in 2017 as developers continue to face financing and bureaucratic hurdles. However, more deals will be completed on time. The number of hotels opened as scheduled increased from only 26 percent in 2014 to 47 percent in 2016.

"With many more rooms in the pipeline and a much higher proportion being built on time, one has to recognize that hotel development in Africa is becoming an increasingly serious business," Matthew Weihs, MD of Bench Events, said in a statement.

In October, industry leaders and government officials will discuss the report and the challenges of developing new hotels in Africa during the seventh Africa Hotel Investment Forum in Kigali.