Industry pundits have been floating around numbers regarding occupancy and construction in a bid to determine when the current cycle is expected to end, but occupancy could be the wrong indicator. According to Hospitality Directions, a new lodging forecast released by PwC U.S., occupancy in the U.S. is stabilizing after reaching peak levels in 2015 while average daily rate growth has fallen to the lowest levels since Q4 2013.

Scott D. Berman, principal and U.S. industry leader, hospitality & leisure at PwC, said the best word to describe the current and future hospitality climate is "retraction," not "deceleration." He maintains that the industry is still growing and looks positive, but some of the numbers don't add up.

"I'm most focused on rate right now," Berman said. "There is compression on rate when occupancy is strong, and the opposite is happening, which defies all logic."

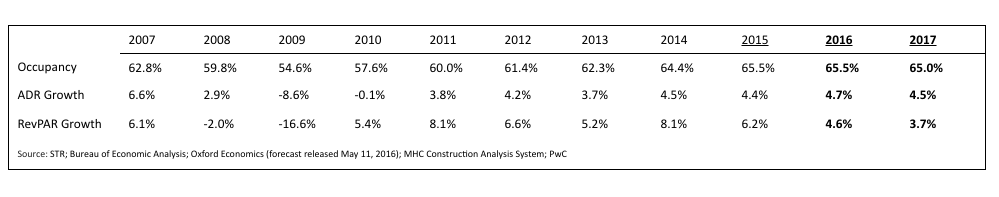

For example, according to PwC's report, occupancy has climbed upward from 62.3 percent in 2013 and stabilized at 65 percent in 2015 and Q1 2016, thanks in part to strong group travel indicators. In addition, ADR has grown from 3.7 percent in 2013 to 4.4 percent in 2015 while growing 3.2 percent in Q1 2016. However, PwC is forecasting ADR growth to reach 4.7 percent by the end of the year. Meanwhile, revenue per available room tells a different story, rising from 5.2 percent in 2013 to 6.2 percent in 2015 before rising 2.7 percent in Q1 2016, and PwC is forecasting 4.6-percent growth for the entirety of 2016.

According to Berman, a number of factors have contributed to this RevPAR dropoff, primarily a weak Q1 2016 that the industry is still playing catch-up on. While Berman says the industry is expected to regain much of its strength for the rest of the year, he admits forecasting the numbers has become difficult.

"We've become a little bit of a spoiled sector looking at growth over the past two years," Berman said. "In spite of all the pressure, the message for hoteliers is that we're doing just fine. What is wrong with 3-5 percent RevPAR growth? We would have loved it four years ago, but we are comparing it to the high point when we hit 6 percent."

Berman also cautions the industry against being consumed with gloom-and-doom, admitting it is easy to look at the anomalies of Q1 2016 and latch on to negativity.

"If Q1 2016 is the norm then we as an industry need to recalibrate, but all the economists and pundits involved that we subscribe to at PwC are optimistic for 2016 and 2017."