President Donald Trump is proving he's good for business. At least in the lodging sector.

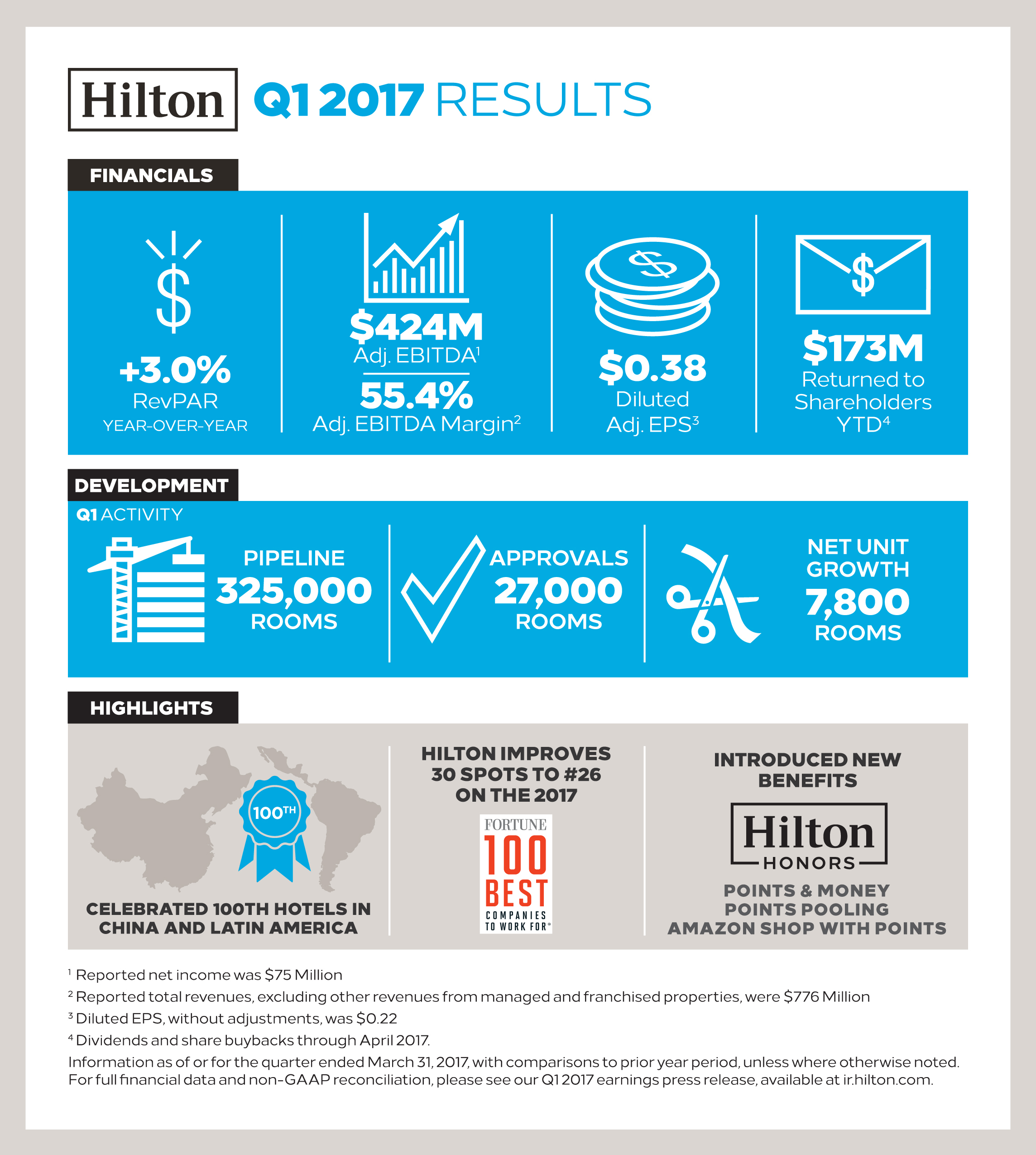

Hilton reported its first-quarter numbers this week, the first since it successfully completed the spin-offs of Park Hotels & Resorts and Hilton Grand Vacations, citing global RevPAR growth of 3 percent, net income of $75 million, a pipeline of 325,000 rooms and net unit growth of 7,800 rooms in the quarter—20 percent more than at the same time last year.

RevPAR in Europe was particularly strong, growing 8.4 percent in the quarter due to transient strength in London and a notably strong March for Italy, Spain and the Mediterranean region. Additionally, international inbound to the UK was up nearly 20 percent in the first quarter, helped by favorable exchange rates and increased travel from the Middle East.

Much of Hilton's growth, as Hilton CEO Chris Nassetta cited, was and continues to be from its new Tru midscale brand. Hilton recently opened its first Tru hotel, in Oklahoma City, and 10 more are expected to open by year-end. Nassetta stated that there are currently 425 Tru hotels in various stages of development, of which roughly 90 percent are with current Hilton owners. A total 75 more are expected to open next year. The Tru brand, according to STR, represents more than 30 percent of the U.S. industry's midscale pipeline.

Beyond Tru, Nassetta remains adamant that his company has the best brands in the business, one of the reasons, he said, Hilton is one of the few lodging companies with a true network effect, whereby a good or service becomes more valuable the more people use it.

"Every one of our brands in every category is either the leader or a category killer in its segment," Nassetta said. "There is no dog in the bunch. So when owners come to us...we have a great product to give them. They are investing in a system to drive top-line and bottom-line performance and drive the best return. I think the fact that we've been able to lead the industry in driving growth and doing it organically without having to use our balance sheet in any meaningful way, it's a pretty darn good testimonial to that. Now we have to keep doing it."

Could there be more brands coming soon? During the earnings call, Nassetta alluded to "four more in the skunkworks." A skunkworks project is one that fosters radical innovation. A spokesperson for Hilton said the company has a number of ideas in the concept phase that are discussed internally, but it would be too early to say there are or will be four new brands announced.

Not surprisingly, Nassetta hailed the limited-service space, and while he stopped short of bemoaning full-service development, he was adamant that the limited-service space is where investors are seeing the best returns.

"The bulk of development is going on in the limited-service space," he said. "There is a real simple reason for it: that's where the demand growth is, where the economics work and that's why owners are investing money to build new properties in those segments because they're getting the returns there.

"When you look at the costs to build and to operate and cost to build new construction for full service and luxury, it works in a few places, but it doesn't work in many. This development cycle doesn't involve a ton of upper upscale and luxury," mainly, as he later said, the economic rationale doesn't support it currently.

He added that he doesn't expect a spate of new development in upper upscale and luxury any time soon, "because I don't see economics that on a wholesale basis are going to support it for some time. I think the game is in limited service."

Post-Election Bump

During analyst Q&A, the first question posed to Nassetta concerned "post-election euphoria" with Barclays Felicia Hendrix asking: "Have you seen group demand and business transient demand ebb and flow with different ways of sentiment or has the uncertainty regarding various administration policies caused corporate customers to sit on their hands again?"

Nassetta responded that the leisure transient side hasn't seen ups and downs associated with the election, but that business transient has been impacted. "If you think about pre and post election with business transient, pre election, [it was] quite anemic to flattish. Post-election, we saw it step up a little bit. And we've seen it remain pretty consistent since. So, we saw a little bit of post-election bump and it's remained."

Nassetta said he believes they'll see further pickup, irrespective of a lethargic Q1 GDP report. "It's early in the year, it's early in the Trump administration and this legislative agenda. And I think we need to see it play out," he said. "There's still a descent amount of uncertainty around certain foreign policy issues going on and the legislative agenda, health care, tax reform, infrastructure and regulatory."

President Trump's travel ban executive order has up to now been stymied by the courts, but according to Nassetta, the impact was small on Hilton's overall inbound business. The strong dollar, he said, likely will have more an effect on inbound international business. "Interestingly, last year revenues from international arrivals was down about 3 percent," he said. "It was off for a host of reasons, [but] I'd say predominantly [it was] the strength of the dollar.

"If you look at it in the first quarter, revenues from international inbound business was actually up a little bit—flat to up 1 percent."

International Expansion

Beyond the U.S., according to Nassetta, will be Hilton's biggest growth focus moving forward—internationally being where it still hasn't reached a critical mass of its brands. "There is still more opportunity in that regard," he said. "We are in a lot of places, but we are at the tip of our iceberg of international growth. Over the next five or 10 years, you're going to see our percentage growth coming from other places around the world."

Helping drive that growth will be the aforementioned Tru brand, but also Hilton's Hampton brand, especially in China. In 2014, Hilton and Plateno Hotels Group entered into an exclusive license agreement to develop the Hampton by Hilton brand in China. Hilton at the time said it was eyeing 400 Hampton hotels for the country. "Huge good things [are] going on in China with limited service, particularly with our deal with Plateno," Nassetta said. "A ton of new Hamptons went under construction in the first quarter. Now, we're going to have a ton more coming, but my sense is it will stabilize out that Tru and Hampton in China will help supercharge the first quarter a bit."