Budget season is upon is. Yes, it's Q4; that time of the year to pop in your pocket protector and estimate your revenues and expenses for next year. It can be a painstaking process, but one that needs to be treated with utmost care: not too high, not too low.

HOTEL MANAGEMENT polled its readers to see how their 2017 budget season was shaping up and what their plans were for their hotels.

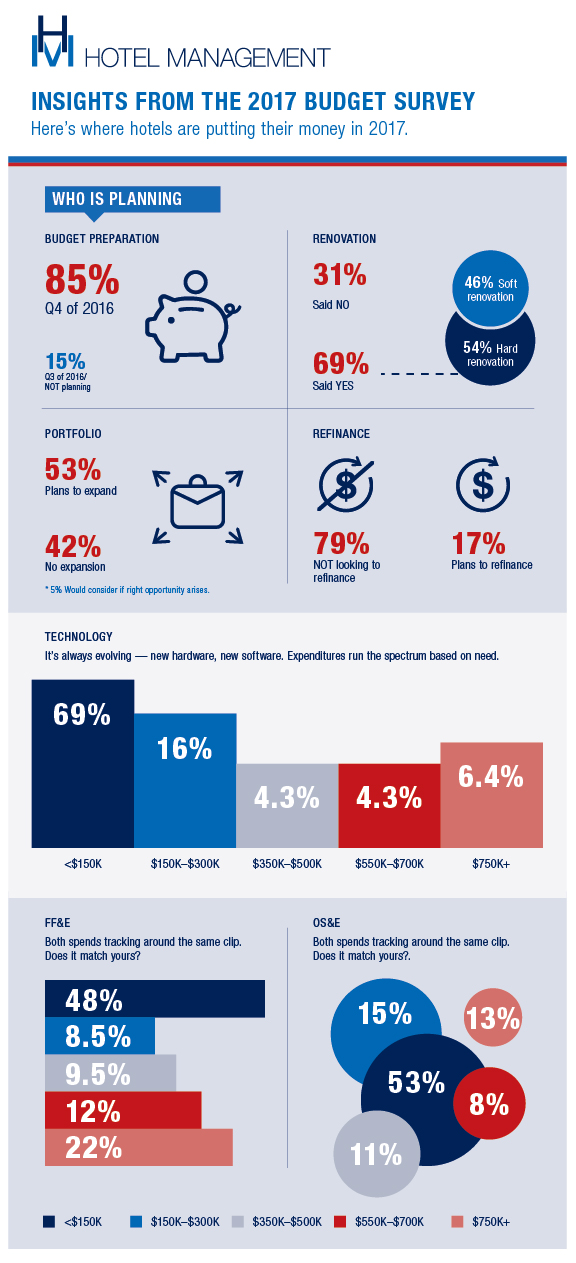

The abundance do, indeed, prepare their 2017s budget in Q4, and almost 70 percent of respondents declared they'd be deploying capital toward renovations next year. It was pretty much split down the middle between hard and soft renovations—the former having a slight advantage.

Technology continues to dominate budget discussions in terms of how much money to put toward it. The majority of respondents—70 percent—noted that they'd be spending less than $150,000 in 2017 on technology upgrades. On the other end of the spectrum, a smaller percentage—6 percent—said they'd be spending north of $750,000 on technology in 2017.

When it comes to FF&E, the breakout was similar to technology on a spend basis. While around 48 percent of respondents said they'd be spending less than $150,000, 22 percent of respondents noted they'd be spending more than $750,000. A smaller 12 percent said they'd be spending between $550,000 and $700,00 on FF&E. Meanwhile, more than half also said they'd spend less than $150,000 on OS&E.

Curiously, the vast percentage—79 percent—said they would not look to refinance their hotel in 2017, perhaps a sign that they are happy with their current rate or suspect a rate hike next year.